Special Edition: CDFA Tax Increment Finance Update - TIF State-by-State Map & Report

|

|

| Tax Increment Finance State-by-State Map & Report |

In this special edition of CDFA's Tax Increment Finance Update we are excited to announce the release of the CDFA 2015 TIF State-By-State Report, a review of recent alterations regarding current state statutes and related regulations governing the use of tax increment and similar special district financing tools. The report provides a summary of several states’ enabling statutes with respect to key changes since 2012 that are designed to expand, limit, or improve the tool’s use. In addition, graphs and charts illustrating key trends from across the country are provided, including statute requirements related to maximum district length, eligible tax revenue sources, and the presence of blight for district creation.

Eleven states have enacted amendments to their TIF statutes since 2012. Some of these changes have significant impacts on the use of the tool, as discussed for the following states. |

| | Alabama |

In 2013, the State of Alabama passed the Major 21st Century Manufacturing Zone Act. The legislation broadens the use of TIF in an effort to help cities attract large manufacturing projects. The new law allows cities to create manufacturing TIF zones for a range of industries, including: automotive, aviation, medical, pharmaceutical, semiconductor, computer, electronics, energy conservation, cyber technology, and biomedical if at least $100 million is invested on a site larger than 250 contiguous acres.

| | California |

More than 400 Community Redevelopment Agencies (CRAs) were officially dissolved in 2012 as a result of legislation passed by the state legislature, effectively eliminating California cities’ ability to utilize TIF for redevelopment purposes. Reasoning for the legislation focused on the direct and indirect effects CRAs had on the state budget.

Local governments are still capable of financing infrastructure improvements through a TIF structure by creating Infrastructure Financing Districts (IFDs). In September 2014, A.B. 313 was passed to facilitate more infrastructure investment at the local level by improving upon the current IFD structure. This piece of legislation enables cities and counties to create Enhanced Infrastructure Financing Districts (EIFDs).Under the new law, EFIDs provide an alternative means for cities or counties to finance public infrastructure in former redevelopment project areas that have been dissolved or are in the process of being dissolved.

| | Colorado |

Colorado House Bill 1348, gives non-city entities three voting seats on 13-member urban renewal authorities that have been largely formed by municipal officials. The bill also requires cities and counties to seek a third-party mediator if the allocation of a county’s future property-tax revenue and a city’s future sales-tax revenue can’t be determined as it relates to TIF projects. The legislation was created to address complaints from counties that believe urban renewal projects can adversely affect their property tax revenues, in addition to claims that other taxing jurisdictions are worthy of more voting power.

| | District of Columbia |

The District's TIF enabling statute expired on January 1, 2014, and has not been reauthorized, meaning the District is not able to issue additional debt under the TIF Act. The District has been using project-specific TIF statutes rather than proceeding under a general TIF statute, resulting in the authorization of new TIF districts and projects on a deal-by-deal basis.

| | North Dakota |

North Dakota recently increased the maximum length of a TIF district to be 25 years, a 10-year increase compared to the previous requirement. The base year for tax increments may not be used for more than 25 taxable years without establishing a new base year -- the new base year may be used for an additional 5 years after which time the tax increment district must be closed.

| | Missouri |

There have been three recent amendments within Missouri's statute. In 2013, legislation was passed that excludes from TIF capture sales taxes imposed for the purpose of operating and maintaining a metropolitan park and recreation district, or for the purpose of emergency communication systems. Legislation was passed in 2014 stating if the voters in a taxing district approve an increase to a taxing district’s levy, then the additional revenues generated within an existing redevelopment project area from the voter-approved increase to the tax levy will not be subject to capture without the taxing district’s consent. Another amendment was passed in 2014 stating if the voters in a taxing district approve a new sales tax then the revenues generated within an existing redevelopment project area from the new sales tax will not be subject to capture without the consent of the taxing district.

| | Trends |

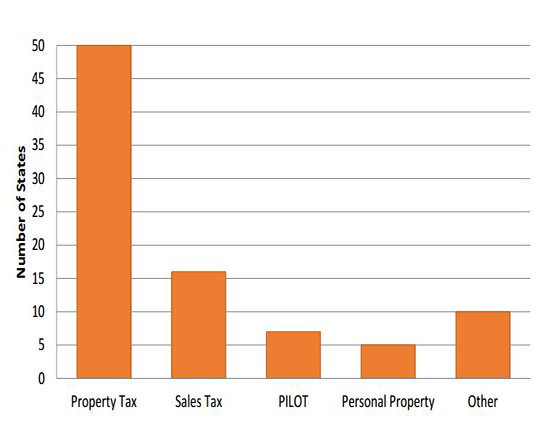

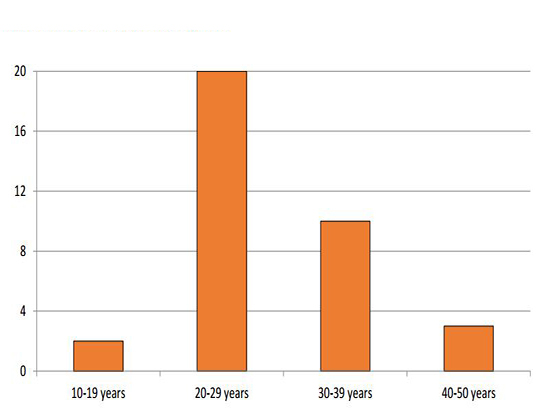

The following section provides an overview of general trends concerning important components of state-enabling TIF statutes from across the country.

The chart above shows the eligible tax revenue sources as displayed in TIF enabling statutes.

The maximum district length is displayed to show the vast disparity among state requirements.

|

| Resources |

As the industry leader of TIF resources, CDFA offers a dedicated TIF Resource Center and two in-depth courses that examine the guiding principals and appropriate application of TIF.

>>> TIF Resource Center

>>> Intro to Tax Increment Finance Course

>>> Advanced Tax Increment Finance Course

|

The Council of Development Finance Agencies is a national association dedicated to the advancement of development finance concerns and interests. CDFA is comprised of the nation's leading and most knowledgeable members of the development finance community representing public, private and non-profit entities alike. For more information about CDFA, visit www.cdfa.net or e-mail info@cdfa.net.

|

Council of Development Finance Agencies

100 E. Broad Street, Suite 1200

Columbus, OH 43215

(614) 705-1300

info@cdfa.net

|

|

|

Archives

Displaying 1 - 30 of 162

| April 23, 2024 |

| March 26, 2024 |

| February 27, 2024 |

| January 23, 2024 |

| December 26, 2023 |

| November 28, 2023 |

| October 24, 2023 |

| September 26, 2023 |

| August 22, 2023 |

| July 25, 2023 |

| June 27, 2023 |

| May 23, 2023 |

| April 25, 2023 |

| March 28, 2023 |

| February 28, 2023 |

| January 24, 2023 |

| December 27, 2022 |

| November 22, 2022 |

| October 25, 2022 |

| September 27, 2022 |

| August 23, 2022 |

| July 26, 2022 |

| June 28, 2022 |

| May 24, 2022 |

| April 26, 2022 |

| March 22, 2022 |

| February 22, 2022 |

| January 25, 2022 |

| December 28, 2021 |

| November 23, 2021 |

|