Intro Tax Increment Finance Course Speakers

Lindsay Banner Cigole

Understanding TIF Bond Financing

Thursday, June 27, 2:15 - 3:30 PM

Director

ORIX

In her role as Director at ORIX Municipal Finance, Lindsay Cigole is responsible for municipal portfolio debt originations and real estate debt originations, along with assisting in the evaluation, review, and monitoring of ORIX Municipal Finance’s investment and trading portfolio. Prior to joining ORIX, Ms. Cigole served as a Vice President for MuniCap, certified as a Series 50 Municipal Advisor. During the eleven-year term at MuniCap, Ms. Cigole assisted in providing a multitude of developers and municipalities, in over fifteen states, access to nearly $1 billion in capital for construction of public infrastructure through the issuance, refunding, or restructuring of special district bonds, secured by tax increment and special assessment/special tax revenues.

Ms. Cigole is a graduate of Clarion University where, as a member of the women’s volleyball team, she graduated summa cum laude from the Honor’s Program with a Bachelor of Science in Business Administration in International Business, Personal Finance, and Economics and a minor in French. Ms. Cigole also holds a Master of Science in Real Estate from Johns Hopkins University. She served on inaugural committee for the Urban Land Institute – Baltimore, Women’s Leadership Initiative. Ms. Cigole currently serves on the Clarion University College of Business and Information Sciences Advisory Council and the Clarion University Center for Career and Professional Development Advisory Council. In addition, she is active in the Urban Land Institute, the Women in Public Finance, the Council of Development Finance Agencies, the Lambda Alpha International Land Economics Society, and is a guest speaker for several industry related organizations. In 2018 Ms. Cigole began instructing at Clarion University as a temporary professor in the Finance Department.

Elena Caminer

Setting the Stage: The Basics of TIF

Wednesday, June 26, 12:15 - 1:00 PM

Senior Project Manager

SB Friedman Development Advisors

Elena specializes in economic and community development, real estate economics, market feasibility, and affordable housing. At SB Friedman, she focuses on helping public, private, nonprofit and institutional clients reach their economic and community development goals responsibly. Her work includes conducting financial feasibility analysis and pre-development planning, identifying housing needs and strategies to address supply and affordability challenges, and conducting financial due diligence and evaluating real estate readiness to determine the appropriate level and structure of public and philanthropic financial analysis. Select projects include: Chicago's Central Area Plan 2025; a financial feasibility analysis and Transit TIF district designation for the Chicago Transit Authority's Red Line Extension project; TIF and other funding applications for affordable housing clients in Chicago; housing studies in Glen Ellyn and Naperville, IL, Sun Prairie, WI, and the Charleston, SC region; and analysis of unmet needs and community development programs in low-income neighborhoods throughout Maryland in support of a strategic plan for a new community investment corporation. Elena graduated magna cum laude from Barnard College at Columbia University with a Bachelor of Arts in Urban Studies and summa cum laude from the Jewish Theological Seminary of America with a Bachelor of Arts in Ethics.

Andres Caro

Welcome & Overview

Wednesday, June 26, 12:00 - 12:15 PM

Revisiting Day 1

Thursday, June 27, 12:00 - 12:15 PM

Manager, Advocacy & Government Affairs

Council of Development Finance Agencies

Andres Caro is the Manager, Advocacy & Government Affairs in the Strategy & Services Division at CDFA. He is responsible for managing CDFA’s vast advocacy, legislative, policy, public affairs, and federal relations activities. This includes the production of the annual policy agenda, the Federal Policy Conference, and leading Capitol Hill engagement. Caro is also responsible for managing the CDFA Legislative Committee and works to provide access to CDFA Federal Services to communities throughout the country. His responsibilities have also spanned research, technical assistance, and coordination of grant contracts.

Andres holds a B.S. in Political Science from The Pennsylvania State University.

Carrie Cecil

The Basics of TIF Underwriting & Deal Making

Thursday, June 27, 12:15 - 2:00 PM

Partner

Frost Brown Todd LLP

Carrie’s practice focuses on public and project finance. She has served as bond counsel, issuer’s counsel, underwriter’s counsel, bank or purchaser’s counsel and disclosure counsel in municipal finance transactions. Her practice also includes the financing and development of infrastructure and economic development projects, including tax increment financing and tax abatement structures. In addition, Carrie works with clients to prepare post-issuance compliance procedures for issuers and borrowers of tax-exempt bonds and assists with post-issuance contract review.

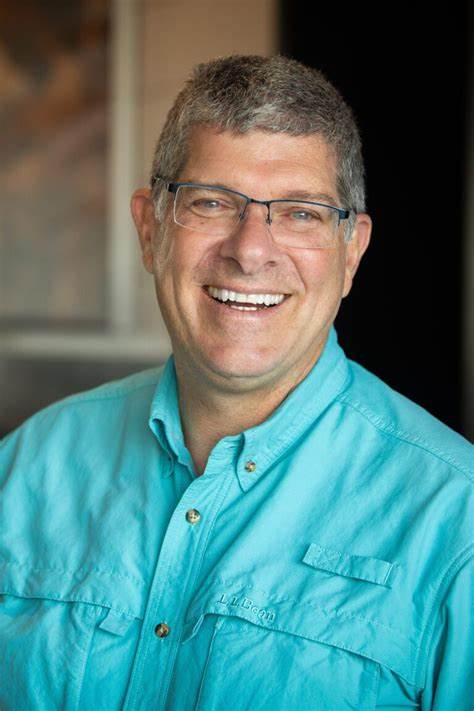

Brett Doney

Understanding TIF Bond Financing

Thursday, June 27, 2:15 - 3:30 PM

President & Chief Executive Officer

Great Falls Development Authority

Brett Doney leads the Great Falls Development Authority, a public/private economic development partnership serving the 12-county Great Falls Montana trade area. Doney has over 30 years of experience in urban and rural community economic development. Prior positions include: President/CEO of Enterprise Maine, a family of community economic development organizations dedicated to creating economic opportunity and enhancing the quality of life in rural western Maine; Director of the Ft. Devens Reuse Center, a 9,600 acre army base redevelopment planning effort in Massachusetts; and, President of Doney Associates, a Boston-based consulting firm focused on urban revitalization, public/private real estate development, and innovative economic development.

Doney’s team efforts have won awards from the U.S. Small Business Administration, the American Economic Development Council, the International Economic Development Council, the National Association of Development Organizations, the Finance Authority of Maine, the Montana Economic Developers Association, and the National Brownfield Conference. His professional certifications include Certified Economic Developer (CEcD), Master of Corporate Real Estate (MCR), Senior Leader of Corporate Real Estate (SLCR), American Institute of Certified Planners (AICP), RMA Credit Risk Certification, Federal Grants Management, and Economic Development Finance Professional (EDFP). He is a graduate of the Economic Development Institute of the University of Oklahoma. Doney earned a Bachelor of Arts in Political Science from the University of California at Santa Barbara and a Masters in Public Policy from the Kennedy School of Government at Harvard University.

Doney has taught, given presentations, and served on technical advisory teams for a variety of state, national and international economic development and industry organizations. He currently serves on the boards of the Montana Economic Developers Association, the Great Falls Convention & Visitors Bureau (Chair), the Downtown Development Partnership of Great Falls (Chair), and the Upper Missouri River Heritage Area Planning Corporation. He serves on the International Economic Development Council’s Accreditation and Public Policy Advisory Committees, as the Montana Government Relations Chair for the International Council of Shopping Centers, and on the McLaughlin Research Institute’s National Development Council. He is an active Rotarian and past President of the Great Falls Rotary Club.

David Hawes

Combining & Leveraging TIF with Other Tools

Thursday, June 27, 3:45 - 5:00 PM

Managing Partner

Hawes Hill & Associates, LLP

David W. Hawes is founder and senior partner of Hawes Hill Calderón LLP, a professional consulting services firm that specializes in the creation and administration of municipal management districts, public improvement districts, tax increment reinvestment zones, and other public/private financing strategies that yield community improvement. He serves as the executive director of numerous districts and zones, guiding the development and revitalization of communities within the greater Houston metropolitan region and throughout Texas.

Prior to founding Hawes Hill Calderón in 1995, Mr. Hawes was the City of Houston’s Finance and Administration Revenue and Research Manager, where he served as chief economist and member of the city’s Bond Financing Team. In the 1980s and ‘90s, his experience included serving as CEO of a state-wide nonprofit corporation that provided residential treatment services to adolescents, and as Assistant Commissioner Finance for Texas Department of Human Services’ and served as the Texas Medicaid Budget Director, the third largest in the U.S.

Mr. Hawes holds a bachelor of arts in government from the University of Texas at Austin and a master of arts in public administration from the University of Houston. His articles on public financing methods have been published in Houston Economics and Urban Growth and Decision-Making. A member of the Council of Development Finance Agencies, he is a frequent workshop presenter and adviser to Texas cities and counties regarding public financing and incentives issues.

Brendan Heil

TIF Legal & Procedural Nuts & Bolts

Wednesday, June 26, 1:00 - 2:15 PM

Of Counsel

Bricker Graydon

Brendan Heil is a seasoned attorney in Bricker Graydon's Political Subdivision group. Brendan has extensive experience handling a variety of municipal law issues, including counseling cities and private entities on economic development transactions, public finance, legislation, eminent domain, annexation, land use, and zoning. Brendan is also well-versed in handling litigation matters for public and private clients in federal and state courts, including land use and zoning disputes, complex commercial class actions, and multi-district litigation.

Caren Kay

The Basics of TIF Underwriting & Deal Making

Thursday, June 27, 12:15 - 2:00 PM

Senior Vice President

SB Friedman Development Advisors

Caren specializes in urban economics, land use planning and real estate development. Her experience at SB Friedman includes a financial analysis to assist in the negotiation and structuring of a public-private partnership for redevelopment of the former Michael Reese Hospital site in Chicago and market assessments for two Urban Renewal Districts in Boise, Idaho, which were used during a public improvement feasibility planning process. Prior to joining SB Friedman, Caren spent time working as a Mayoral Fellow in the Chicago Mayors Office where she was involved with the launch of the Retail Thrive Zone Program and prepared preliminary research for the Industrial Growth Zone Program. Caren holds a Master of Regional Planning from Cornell University with a concentration in Economic Development Planning, and a Bachelor of Arts in Public Administration and Urban and Regional Planning from Miami University. She is a member of the American Planning Association (Illinois and Ohio Chapters), and is a licensed real estate broker in Illinois.

Emmett Kelly

TIF Legal & Procedural Nuts & Bolts

Wednesday, June 26, 1:00 - 2:15 PM

Attorney

Frost Brown Todd LLP

Emmett is a partner in the Columbus office and practices in the Lending and Commercial Services and Government Services practice group. He has served as bond counsel, structuring counsel, underwriter's counsel, developer's counsel and purchaser's counsel for various taxable and tax-exempt project and revenue bond financings, including private activity bonds (IDB's), municipal, education, health care financings, renewable and alternative energy, and traditional general obligation, 501 (c)(3) issues.

He serves as bond counsel and special counsel on economic development financing and incentive projects utilizing tax increment financing, joint enterprise development districts, enterprise zones, energy special improvement districts, and community reinvestment areas. Emmett also serves as counsel to economic development entities such as community improvement corporations, new community authorities, regional planning commissions, convention facilities authorities, water and sewer districts, and port authorities on general, economic development and special obligation revenue financing matters. In the traditional general obligation area, he serves as bond counsel, underwriter's counsel and purchaser's counsel for general obligation, special obligation revenue bond and note financings for municipalities, school districts, counties, townships, port authorities, convention facilities authorities and other public sector entities.

In the area of property assessed clean energy (P.A.C.E.), renewable and alternative energy projects and on P3's (public/private partnerships) transactions Emmett has served as legal counsel and as a consultant. He has worked on P3's, which have included tax increment financing, special assessments, private equity and assets, and governmental services and assets, for land development projects and public works.

Naina Magon

Combining & Leveraging TIF with Other Tools

Thursday, June 27, 3:45 - 5:00 PM

Principal

Hawes Hill & Associates, LLP

Naina Magon has over 25 years in economic development, planning and finance experience in municipal government and consulting at the city, county and regional levels. She has served both public and private sector clients in facilitating new investment and development/revitalization efforts through creative and implementable solutions, including financing of public infrastructure and projects. Naina has worked with communities in evaluating their current economic situation, identifying opportunities, and developing strategic plans with solutions to move forward. She has successfully combined her passion for planning and economic development, allowing her to create and implement comprehensive and inclusive solutions for communities, with the goal of enhancing prosperity and fostering growth.

As a Principal with Hawes Hill & Associates, she has been involved in the creation and management of special districts including Tax Increment Reinvestment Zones and Municipal Management Districts, throughout the State of Texas. She specializes in assessing existing conditions and needs, project feasibility, financial analysis, project implementation and development agreements. Her background in economic development and planning along with her experience in development finance have allowed her to work with clients in crafting solutions and creative financing mechanisms for funding public infrastructure and achieving community goals.

Naina has a bachelor’s degree in economics from the University of Calgary and a master’s degree in urban and regional planning from Texas A & M University. She has worked with communities all over Texas and served on several panels speaking on the creative use of public financing in achieving community goals.

Emily Metzler

TIF Financing Variations

Wednesday, June 26, 2:30 - 3:45 PM

Managing Director

Stifel Nicolaus & Company, Inc.

Emily Metzler has served over fifteen years as part of the MuniCap team. Ms. Metzler is passionate about real estate, furthering economic development opportunities, and assisting with the critical thinking aspect of creative funding mechanisms. In her position, Ms. Metzler manages over fifty different large-scale, catalytic development projects across thirty+ states at any given time. She actively participates in all aspects of the financial structure of each deal from conception to capitalization, implementation, and administration post issuance. In addition, she is responsible for new business development efforts in the markets for which she serves. Since joining MuniCap, Ms. Metzler has assisted with the issuance of publicly marketed bonds in excess of $2.0 billion. Furthermore, she has worked extensively on multiple transactions that have resulted in the first issuance of their kind in their respective jurisdictions.

Ms. Metzler is a 2005 graduate of Clarion University, Pennsylvania (now PennWest). She graduated with a degree in both real estate and finance. Ms. Metzler was an active member of the Financial Management Association, played intramural basketball, and obtained her real estate license for the Commonwealth of Pennsylvania during her college career.

Following graduation from Clarion University, Ms. Metzler was hired into the management program at National City Bank, now PNC, before being hired at MuniCap.

Ms. Metzler is active in multiple organizations including the Association of Public Finance Professionals, Council of Development Finance Agencies (also serving as a board member and chairman of the strategic planning committee), Urban Land Institute, Lambda Alpha International, Women in Public Finance (National, Maryland, and Virginia Chapters), and serves on the Compliance Advisory Group providing municipal market perspectives with the Municipal Securities Rulemaking Board (MSRB). Ms. Metzler is a registered Municipal Advisor (Series 50) and has passed the Municipal Advisor Principal Qualification Examination (Series 54). Ms. Metzler serves as MuniCap’s Chief Compliance Officer.

David Misky

Combining & Leveraging TIF with Other Tools

Thursday, June 27, 3:45 - 5:00 PM

Assistant Executive Director

City of Milwaukee

Dave Misky is the Assistant Executive Director of the Redevelopment Authority of the City of Milwaukee, an independent corporation of City government which has a mission to eliminate blighting conditions that inhibit neighborhood reinvestment, to foster and promote business expansion and job creation, and to facilitate new business and housing development. He has 30 years of diversified experience in real estate and economic development with a strong focus on creative financing and environmental issues. He currently oversees the City of Milwaukee’s Real Estate programs including residential and commercial foreclosures, City-developed industrial developments, and Brownfield redevelopment. Dave and his team manage all sizes of developments from small vacant residential lots to vast economic drivers that address development plans, zoning changes, gap financing, stormwater management, and environmental aspects of remediation and sustainability. These projects include major developments along each of the three rivers of the City of Milwaukee and Lake Michigan. Dave holds a Bachelor of Science degree in Biological Sciences from the University of Wisconsin-Milwaukee and a Master of Science degree in Water Resources Management from the University of Wisconsin-Madison.

Michael Ringle

The Most Overlooked TIF Element: Addressing Buy-in Public Policy

Wednesday, June 26, 4:00 - 5:00 PM

Attorney

Bricker Graydon

Mike Ringle serves as an attorney within the firm’s public finance team, partnering with private and public entities of all types and sizes to help them fund their capital projects. He is knowledgeable of both public law and innovative financing structures, guiding his clients throughout each phase of routine and complex transactions.

As a certified public accountant (CPA), Mike is qualified to offer counsel on state and local tax matters. Additionally, he has vast experience working within public offices, allowing him to understand his clients’ position in unique transactions, including the formation of port authorities, energy special improvement districts, joint economic development districts, new community authorities, and the implementation of real property tax exemptions.

As an accountant, elected official, and attorney, Michael has been trusted in overseeing public projects involving billions of dollars and has managed large portfolios of real property and other assets.

Previously, Michael held various professional roles with national, state, and local entities, including Delaware County, the Ohio Treasurer of State, the Ohio House of Representatives, the U.S. District Court for the Southern District of Ohio, and the United States Senate. He is also a former tax associate with global accounting firm KPMG.

Andy Struckhoff

The Most Overlooked TIF Element: Addressing Buy-in Public Policy

Wednesday, June 26, 4:00 - 5:00 PM

President

PGAV Planners, LLC

Andy Struckhoff brings to PGAV a variety of skills in economic and community development. Andy’s professional career includes both public and private sector experience. Andy has led underwriting activities analyzing potential acquisitions, tax increment financing planning activities including composing redevelopment plans and cost/benefit analyses, business retention and recruitment projects, undertook return analysis activities and also performed a variety of demographic analyses. Andy works with communities to develop solutions regarding open space, neighborhood, downtown planning, and public financing. His breadth of experience allows him to engage in projects as varied as land use policy, fiscal impact analyses, and market analyses. He also works with communities to develop effective policies and guidelines for using public incentives to attract private development.

Max Ungerman

TIF Legal & Procedural Nuts & Bolts

Wednesday, June 26, 1:00 - 2:15 PM

Attorney

Bricker Graydon

Max Ungerman is a public finance attorney who works with public sector entities to help them finance a variety of development projects. He is experienced in tax increment financing (TIF), community reinvestment area (CRA) incentives, transformational mixed-use development (TMUD) tax crediting, new community authority (NCA) implementation, project and ground lease incentives, and property-assessed clean energy (PACE) financing, guiding clients through all proceedings and every stage of these transactions. Additionally, he has also worked with the formation of joint economic development districts (JEDD).

Max has extensive administrative experience supporting municipalities and other public entities with their legal needs. He drafts ordinances and resolutions on behalf of municipalities and works with municipal officials for document execution. He also creates client engagement letters, drafts inducement letters, and incorporates edits into township law books. Some of his additional skills include compiling school district annual reporting disclosures, utilizing school bonds on OMAC and EMMA, filing entity articles of incorporation, drafting and filing DTE Form 24s, conducting legislation legal research, and utilizing county auditor and recorder data.

As a former public sector fellow with Bricker Graydon, Max gained experience within the education, public finance, and construction industries and is well-versed in legal transactions in several areas of public law. His specific experience includes working with local school districts in areas such as property tax proceedings, funding applications, and competitive bidding contracts.

Kip Wahlers

TIF Financing Variations

Wednesday, June 26, 2:30 - 3:45 PM

Partner

Ice Miller LLP

Kip Wahlers has more than two decades' experience in the field of public finance, economic development and public law. Kip has represented state and local governments at all levels as bond counsel and has also served as underwriters' counsel, bank counsel and counsel to private sector entities doing business with government.

Kip's experience includes financings and projects with port authorities, counties, municipalities, townships and school districts. Kip also advises clients on public records issues and ethics issues.

Kip has authored legislation relating to financing programs in Ohio and elsewhere, including tax credits, loan programs and amendments to legislation establishing new community authorities and authority for impact facilities. He has assisted private companies in obtaining incentives from state and local governments, including tax incentives, tax abatements and tax increment financing.